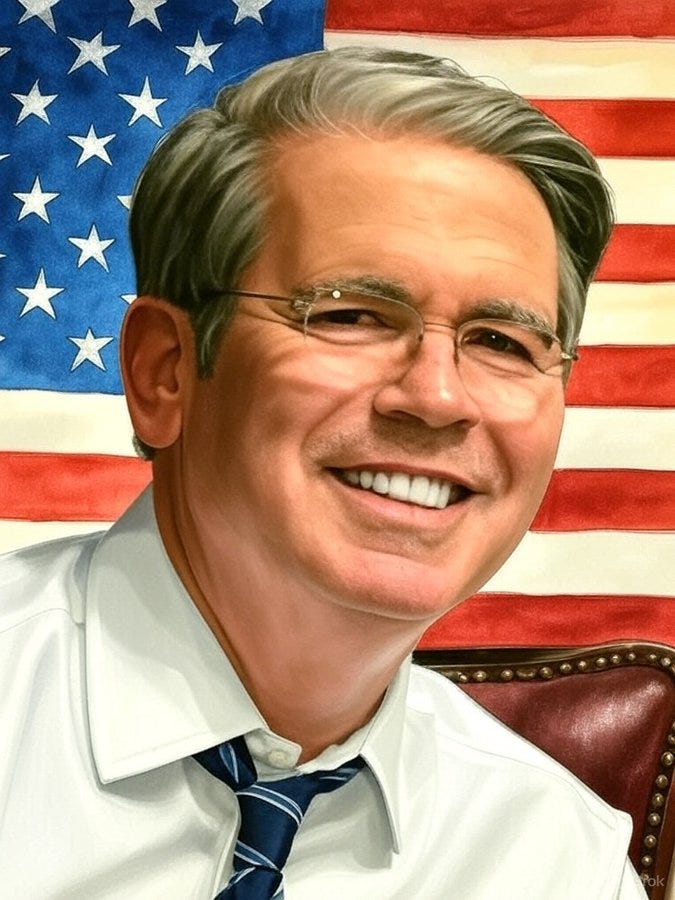

Scott Bessent’s Stance on Tariffs and Their Impact on the Middle Class

Trump’s first term is a prime example of how such policies can yield tangible benefits, revitalizing key sectors and uplifting middle-class livelihoods.

Scott Bessent, a key economic figure and former Treasury Secretary under President Donald Trump, champions tariffs as a vital mechanism to support the American middle class. He views them as a shield for domestic industries, fostering job growth and economic stability for working families. Bessent frequently highlights the steel tariffs from Trump’s first term as a prime example of how such policies can yield tangible benefits, revitalizing key sectors and uplifting middle-class livelihoods.

Positive Results from Trump’s First Term Steel Tariffs

During Trump’s initial presidency, the administration imposed 25% tariffs on steel and 10% on aluminum imports to counter foreign competition, notably from China, accused of flooding the U.S. market with inexpensive steel. Bessent and other advocates argue that these measures sparked a revival in the steel industry, boosting production, reopening factories, and creating thousands of jobs. This resurgence translated into higher wages and greater job security for middle-class workers, demonstrating, in Bessent’s view, how tariffs can bolster the economic backbone of American families. The Economic Policy Institute highlights the added job growth after the first term presidency of Trump placed tariffs on China “Following implementation of Sec. 232 measures in 2018—and prior to the global downturn in 2020—U.S. steel output, employment, capital investment, and financial performance all improved. In particular, U.S. steel producers announced plans to invest more than $15.7 billion in new or upgraded steel facilities, creating at least 3,200 direct new jobs, many of which are now poised to come online.”

Historical Support from Buffett, Pelosi, and Schumer

Bessent’s position finds resonance in broader economic thought and political history. In his 2003 article, Warren Buffett endorsed tariffs to protect U.S. industries, stating, “We should use tariffs to protect our industries from unfair competition, particularly from countries that engage in currency manipulation and subsidize their exports.” This aligns with Bessent’s belief in tariffs as a tool for fairness. Similarly, in 1996, Nancy Pelosi criticized the U.S.-China trade imbalance, noting that while the U.S. levied a 2% tariff on Chinese goods, China imposed a 35% tariff on American products, asking, “Is that reciprocal?”

In the early 2000s, Chuck Schumer also backed tariffs on Chinese goods to address unfair practices like currency manipulation, showing bipartisan recognition of tariffs’ potential. Nancy Pelosi, a prominent Democratic figure, has also voiced support for tariffs on China to protect American jobs. In a 1996 floor speech, she criticized the trade imbalance, noting that while the U.S. imposed a 2% tariff on Chinese goods, China levied 35% on American products. She called the U.S.-China trade relationship a “job loser” and urged Congress to take action, emphasizing how this disparity harmed American workers.

Similarly, in a 2011 floor speech, Pelosi highlighted the loss of a million American jobs due to China’s currency manipulation, advocating for the China currency bill as a necessary step before considering other trade agreements. She argued that China’s unfair trade practices, including currency manipulation and high tariffs, directly contributed to significant job losses in America. This historical support from Pelosi underscores the bipartisan recognition of tariffs as a tool to address trade imbalances and mitigate job losses, aligning with Scott Bessent’s stance on the positive impact of tariffs on the middle class.

Since the election, companies have announced a staggering $1.4 trillion in investments, as reported by Societe Generale’s Kabra, paving the way for approximately 200,000 new jobs. Leading the pack, Hyundai has committed $21 billion to bolster U.S. facilities, with a notable $5.8 billion earmarked for a new plant in Louisiana. Experts suggest that automobile manufacturers are poised to bring production back to American soil, a trend fueled by President Trump’s 25% tariff on imported cars and his promise to impose taxes on critical auto parts, encouraging domestic manufacturing and economic growth.

In summary, Scott Bessent’s support for tariffs rests on their proven ability to strengthen the middle class, as evidenced by the steel industry’s revival during Trump’s first term. Reinforced by Buffett’s economic rationale and historical backing from Pelosi and Schumer, his stance underscores tariffs as a strategic tool to combat trade imbalances and protect American workers. Pelosi’s speeches further highlight the flip side—how unchecked trade disparities with China have led to job losses—lending weight to the argument for tariffs as a corrective measure. Though divisive, tariffs, when thoughtfully applied, offer a pathway to economic resilience for the middle class.

Good article, Andrea! Thanks for sharing it.

Here's a little something that some may find of interest:

https://substack.com/home/post/p-160916532?source=queue

EXCERPT:

"..... On April 7th, Scott Bessent, Treasury Secretary, told Fox News:

"I'll reiterate what I saw last week for countries that don't retaliate. We are at a maximum tariff level, and it is my hope that through good negotiations, all we will do is see levels come down. But that's going to depend on other countries. And you know, President Trump is going to be personally involved in these negotiations, and he believes, as many of us do, that there's been an unfair playing field, so the negotiations are going to be tough."

On Sunday's 'Face the Nation', Howard Lutnick, Commerce Secretary, stated what should be obvious but too many people seem oblivious to acknowledge or care about so long as they get their daily package of Twinkies from the U.S. welfare system, as he noted:

"We don't make medicine in this country anymore. We don't make ships. We don't have enough steel and aluminum to fight a battle, right? ..."

The other side of the coin hinges on various nations' currency manipulations and devaluations and the creation of the euro that have left the Bretton Woods agreement pretty much neutered. Mechanisms outside the regular international monetary system have persisted in a manner that no nation would have agreed to accept in normal negotiations.

This has given rise to predictable problems and imbalances that have been tolerated, while idiot presidents such as George H.W. Bush and their advisors erroneously assumed that any industry lost to globalist offshoring would be of little value and low-tech, just as they erroneously assumed the U.S. would always dominate advanced technology. They had largely abandoned our manufacturing and defense industrial base by this time, as well as our shipyards, because they again erroneously assumed that our troubles were over with Russia and the Cold War was done.

And why would anyone worry about China? Wouldn't they soon welcome to become more like us with all our so-called freedoms, liberties and "democracy" after we made them our number one trade partner and paved the way for them to enter the World Trade Organization? No. In fact, the Chinese government has simply grown larger and more hostile. It used the United States' wealth and the technology it steals from the U.S, to arm the largest armed forces on the planet, with a navy that is currently larger than the U.S. Navy, while saber-rattling across the globe and quite likely making preparations to invade Taiwan by 2027.

Currently, the U.S. and Chinese trade is so intertwined that when one sneezes the other farts, but President Trump's administration is attempting to decouple America from the current arrangement which has served to build China into a powerful enough superpower, that it now is emboldened enough to challenge U.S. preeminence on multiple fronts within international relations and affairs, especially as it pertains to international seaways and the sovereignty rights of other nations. But China is facing a debt crisis, much as the U.S. except bigger, with the Chinese total government debt burden at 300% of China's Gross Domestic Product, which is certain to add a known parameter with unknown dynamics and effects to come.

The pressures on China could create an opportunity for a larger economic reordering, but it's unlikely. They have cheated repeatedly on every economic agreement made through the WTO, and there is nothing today to suggest they are any more dependable or trustworthy now than in past years. It's probably best if we completely decouple and rebuild our own capabilities to produce things independent of any Chinese "assistance" or interference, espionage and subterfuge aimed at weakening the U.S. overall.

Isn't it ironic to see old video clips of Senator Chuck Schumer [D-NY] strongly advocating for trade tariffs against China in 2005, as he goes into some great detail on how millions of jobs previously done in the U.S. went to China that year?

On April 3rd 2025, Senator Schumer gave President Trump rare praise, in regard to his new tariff policy:

"I don't agree with President Trump on a whole lot, but today I want to give him a big pat on the back...I have called for such action for years and been disappointed by the inactions of both President Bush and Obama. I'm very pleased that this administration is taking strong action to get a better deal on China." ....."

Times are still tough as we knew they would be. Trump and his people can't turn the economy around all in one fell swoop in only a matter of a couple of months, but he's off to a pretty darn good start, especially in regard to his energy policy and his new broad sweep tariffs in a take-no-prisoners fashion.

Trump's Liberation Day has essentially razed the old economic order and way of doing things to the ground. We've seen a not-so-subtle shift in the American economy that has resulted in a bunch of piss-poor paying jobs that make it so people have to work a full-time and a part-time job or even two full-time jobs just to provide the necessities for their family these days.

If nothing else, Trump's recent actions, Liberation Day specifically, should go down in history as the time that finally killed the myth that Donald Trump only cares about the rich. His economic policies reveal the exact opposite, as he and his people wage a class war of sorts on Wall Street for the sake of America's working class folks. And in retaliation, to punish him, Wall Street is literally just shorting him and his agenda, as they bet against America and the President of the United States.

The oligarchs and so-called "elite" of the upper class of 5th Avenue and Wall Street are betting against President Donald Trump, because they can't stand the notion that there exists a person with power in America who is not on his knees and bowing in front of the great Wall Street Grand Poo-Bahs and asking them, "And what would you like next?" the way both parties have been doing for sixty years or so now.

Trump's plan is to take the country back to the days when a man could actually make ends meet on one paycheck and still manage to take his family on a vacation every so often. A lot of things could still go wrong, but for now, he's got Wall Street and the world set back on their heels.

As Scott Bessent, Treasury Secretary has noted:

"The top ten percent of Americans own eighty-eight percent of the stock. The next forty percent owns twelve percent of the stock market. The bottom fifty percent has debt. They have credit card bills. They rent their homes. They have auto loans. And we've got to give them some relief."

The problem isn't just the inequality and the massive income gap between the extremely poor and the extremely wealthy. It's the overall lack of any real sense of a unified country, regardless of income, largely because the wealthiest Americans today don't seem to care about the poor, or even the middle class who are barely making ends meet and struggling to keep poverty for themselves and their own families at bay.

Creating more purchasing power for the poorest Americans would be good for the growth of America's economy, not bad.

It's not a one-size fits all analysis, but for a multitude of different reasons, America's system hasn't worked too well for the bottom fifty percent of Her people. Most of their stumbling blocks have been created by the crony-capitalist/ fascist protectionism that is prevalent in our society and facilitated by lobbyists and our own Congress. What so many tout as "capitalism" today, just isn't; it's capitalism hollowed out by the Marxist ideology to create a fascist economy which is simply a bad system, and so, it is up to us now to fix the system, which is very near imploding upon itself as the nation rapidly approaches $37 trillion in national debt.

Americans want good jobs. We all want our children to have better lives than we had. Everyone wants and should be able to own their own home in this country, full of so many available resources and so much potential yet untapped. And all responsible Americans who are worth a shit want to pay off their debts rather than ride the welfare system. This isn't really so hard under the right set of circumstances, and our nation should be able to make some great headway in this direction over the next four years or more, depending on who and what comes after Trump.